Buy Now, Pay Later (BNPL) services and online loans are two increasingly popular financing options that provide consumers with flexible payment solutions for their purchases. BNPL allows individuals to make immediate purchases and pay for them over time, typically in interest-free installments. This service has gained momentum in recent years, particularly with the rise of […]

Author Archives: Mr.fintech

No-credit-check loans are financial products that allow borrowers to secure funds without undergoing a traditional credit check to assess their creditworthiness. Unlike conventional loans, where lenders meticulously review an applicant’s credit history and score, no-credit-check loans focus on alternative metrics for evaluating an applicant’s capacity to repay. This is particularly beneficial for individuals with poor […]

The integration of artificial intelligence (AI) and financial technology (fintech) has significantly transformed the landscape of online lending. Over the past decade, the rise of digital lending platforms has disrupted traditional banking practices, providing consumers with quick and efficient access to credit. This shift can be attributed to the increasing demand for streamlined lending processes […]

Online loans have gained significant traction in recent years, providing individuals with fast and efficient access to funds. These loans are typically offered by a variety of financial institutions through digital platforms, streamlining the application and approval process. Unlike traditional banks, which may require extensive paperwork and in-person visits, online lenders allow borrowers to complete […]

Online loans refer to financing options that are offered through digital platforms, enabling small businesses to apply, receive approval, and manage their loans without the need for traditional bank visits. This modern approach to borrowing has gained significant popularity among small business owners due to its convenience and accessibility. The rapid advancement in technology has […]

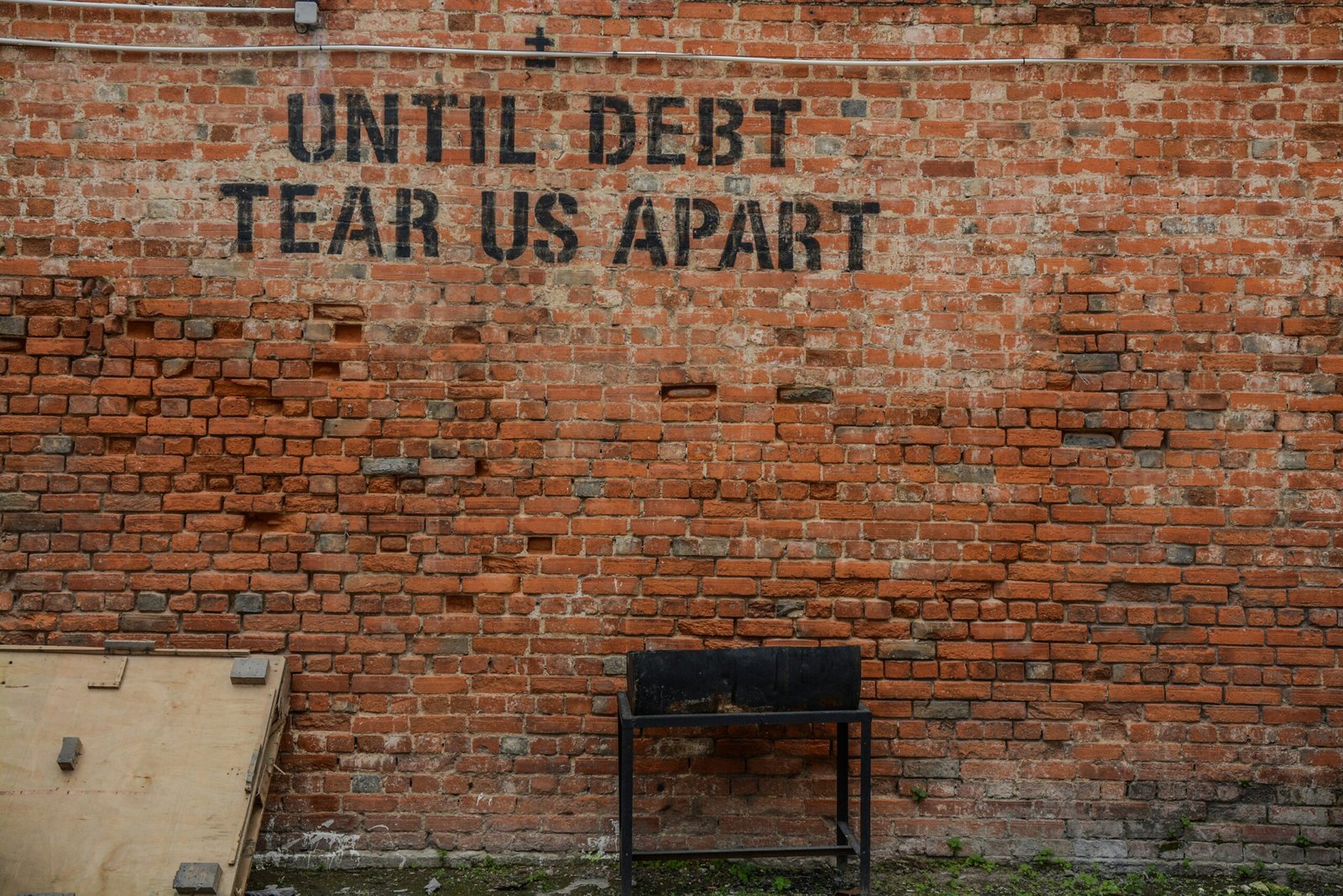

Debt consolidation is a financial strategy that aims to simplify the management of multiple debts by combining them into a single loan or payment. This approach can help individuals alleviate the burden of juggling various payments and interest rates from different creditors. The primary purpose of debt consolidation is to potentially lower monthly payments, secure […]

Understanding the specific terms of your online loan is critical for effective financial management and timely repayment. Each online loan agreement comprises various components that play a significant role in your overall financial planning. Firstly, it is essential to be aware of the interest rate associated with the loan. This rate directly affects the total […]

Online loans represent a modern evolution in the lending landscape, providing borrowers with the convenience of securing funds via the internet. These loans come in various forms, including personal loans, payday loans, and peer-to-peer lending, each designed to meet different financial needs. Unlike traditional loans, which often require a visit to a bank or credit […]

Loan scams represent a pervasive threat within the financial landscape, targeting vulnerable individuals in search of assistance during economically challenging times. These scams operate on the premise of offering quick financial relief, often preying on those who have urgent monetary needs. Scammers typically employ various tactics to appear legitimate, such as using official-sounding names or […]

In recent years, online loans have gained significant traction as a convenient financing option for individuals seeking quick access to funds. Online lending platforms enable borrowers to apply for various types of loans from the comfort of their own homes, eliminating the need for traditional in-person visits to banks or credit unions. This digital approach […]