Online loans are a modern financial solution that allows borrowers to access funds digitally, eliminating the need for traditional banking visits. These loans operate through online lending platforms, which provide an accessible means for individuals to secure financing for a variety of purposes, including personal expenses, home improvement, or debt consolidation. The process typically begins […]

Category Archives: Finance

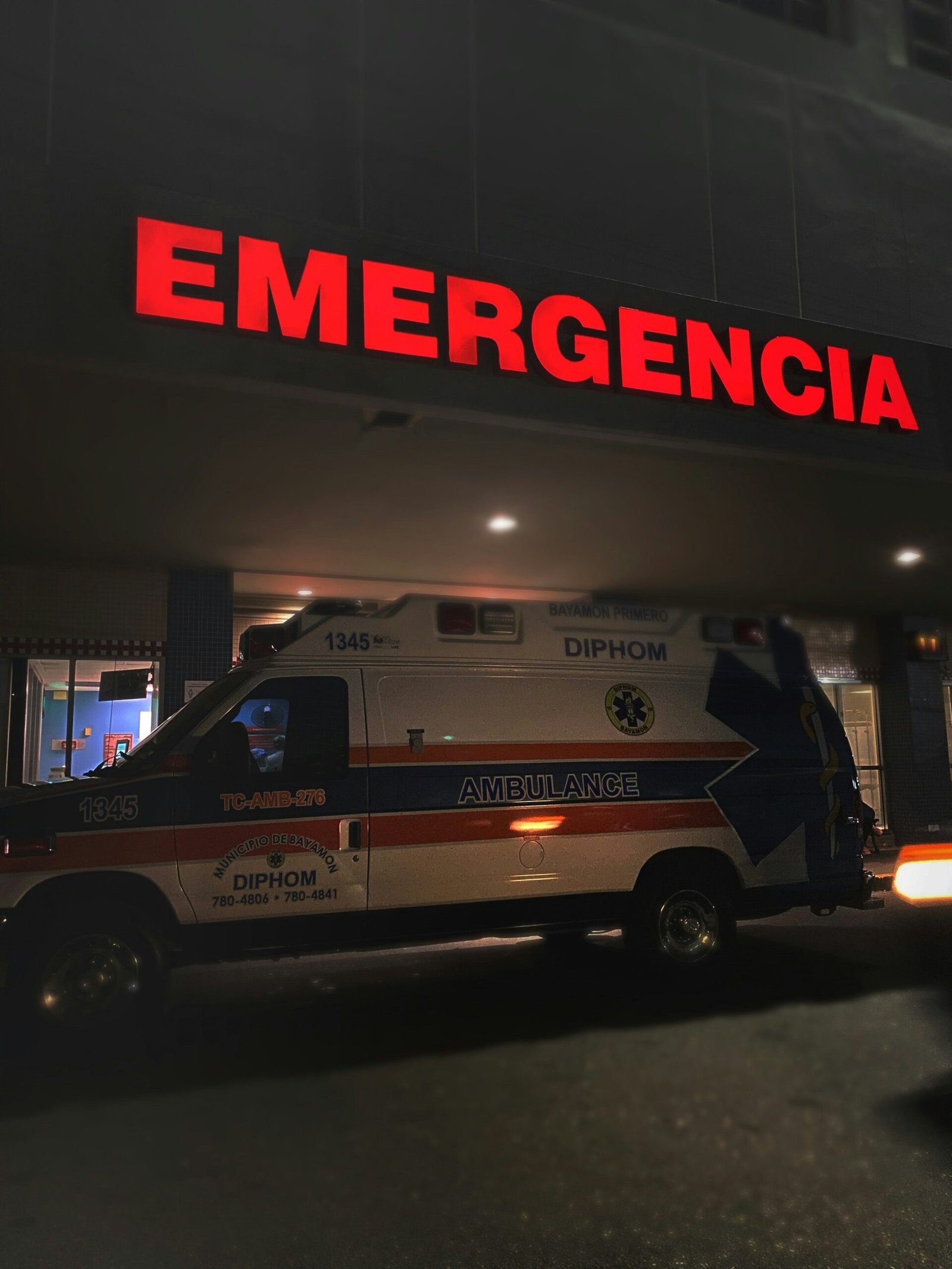

Emergency loans are a type of financial assistance designed to provide immediate cash to individuals facing unexpected financial situations. These loans are typically used to cover urgent expenses, such as medical bills, car repairs, or unexpected home repairs. The urgency of the circumstance often dictates the need for quick cash, enabling individuals to address their […]

Before embarking on the journey to compare online loan offers, it is imperative to gain a clear understanding of your specific loan needs. This foundational step will enable you to identify suitable options that align with your financial goals. The first aspect to consider is the purpose of the loan. Different types of loans serve […]

Before embarking on the application process for an online loan, it is essential to have a comprehensive understanding of your financial situation. One of the first steps in this assessment is to evaluate your income. It is important to calculate your total monthly earnings from all sources, including your salary, bonuses, side jobs, and any […]

Online loans refer to financial products that borrowers can access through the internet, offering a streamlined and often more convenient alternative to traditional lending methods. Unlike conventional loans, which may require in-person visits to banks or credit unions, online loans enable applicants to submit their documentation and applications from the comfort of their own homes. […]

The weight of multiple debts can feel like a heavy burden 🏋️♀️, making the idea of a single, manageable payment incredibly appealing. If you’re navigating this with a less-than-stellar credit history, the siren song of “debt consolidation loans bad credit guaranteed approval” might sound like the perfect solution. But before you set sail on this […]

Life doesn’t always play fair. Just when everything seems under control, boom – your car breaks down 🚗💥, a sudden medical bill appears 🏥💸, or your home springs a leak 🏠💧. These emergencies don’t wait for payday. And if your credit score is less than perfect, getting help can feel nearly impossible. But here’s the […]

The digital economy is booming, and with it, a new era of income generation has emerged. Whether you’re a solopreneur building a Shopify empire, a content creator on YouTube, a freelance designer, or a course creator teaching online – making money on the internet is no longer a side hustle, it’s a full-blown career. 🎯 […]

Online loans represent a modern approach to borrowing, enabling individuals and businesses to access funds through digital platforms rather than traditional banking institutions. These loans encompass a wide range of lending products, including personal loans, business loans, and payday loans, all of which can typically be applied for and managed through the internet. The convenience […]

Online loans have increasingly become a prominent avenue for individuals and businesses seeking financial assistance. The convenience of borrowing money over the Internet has led to a significant surge in the popularity of these services, especially in an era where digital solutions dominate many aspects of life. Unlike traditional bank loans, which may require in-person […]